Studying for the bar exam can put you in a tough spot financially. You’re not just paying for classes anymore; you have exam fees, bar prep courses, and months of living expenses all at once.

The numbers add up: just registering for the exam costs around $500 on average, and including prep courses and living costs can push total expenses into the low five figures.

In this article, I will explain bar exam loans, the difference between federal and private options, and which loan features you should compare so you can plan ahead with confidence.

Key Takeaways

- Bar Exam Expenses Can Be High: The exam fee alone is often a few hundred dollars, and total bar-related expenses can cost anywhere between $2,000 and $7,000.

- Private Loans Only: Bar exam loans come from private lenders, and there is no federal “bar loan” program. They work like specialized private student loans for your bar costs.

- Compare Loan Terms Carefully: Always compare interest rates, origination fees, repayment length, and grace periods.

- Use Federal Aid First: If you’re still eligible, use federal loans with fixed rates. They may offer flexible repayment that private bar loans do not.

- Borrow Responsibly: Only take what you need. A small difference in interest rate or fees can add up over time.

What Exactly is a Bar Exam Loan? (And Why You Might Need One)

Bar exam loan is a specialized personal loan explicitly designed for law graduates preparing for the bar exam. Its main job is to give you the cash you need to cover expenses during that intense study period when you might not earn an income.

How It Differs from Other Student Loans

Unlike the federal student loans you might have used for tuition, bar exam loans are typically private loans. This means they come from banks or private lenders, not the government.

A key difference is that the money from a bar exam loan usually goes directly to you, not to your school. This gives you flexibility but also more responsibility for managing it.

So, what can you use this money for?

Generally, anything related to getting you through the bar exam. This includes:

- Bar review course fees: Those comprehensive and often pricey prep courses can run from $1,500 to over $4,000.

- Exam registration fees: The actual fee to sit for the bar exam, which varies a lot by state, anywhere from $150 to $1,500 or more! For example, New York’s fee is around $250 for most, while California’s can be $850 or higher.

- Living expenses: This is a big one. Rent, groceries, utilities, your phone bill. These costs can add up quickly over a 2-3 month study period.

- Travel and lodging for the exam: If the exam isn’t in your hometown, you’ll need to budget to get there and stay overnight. This could include hotel stays, gas or flights, and meals during the exam days.

- Other related costs: Don’t forget about the Multistate Professional Responsibility Exam (MPRE) fee, which is around $150 – $160, Character and Fitness application fees, which are $100-$500+, sometimes more depending on the state, and even laptop fees for the exam, which are $50-$200. These smaller fees can really add up, making the total cost of bar admission much higher than just the exam fee itself.

Many applicants underestimate the total cost of bar admission, focusing only on the exam fee or prep course. The table below provides a more comprehensive view to help you understand the potential magnitude of funding you might need.

Estimated Bar Exam Related Costs

| Expense Category | Typical Cost Range | Notes |

|---|---|---|

| Bar Review Course Fee | $1,500 – $4,000+ | Comprehensive courses |

| Exam Registration Fee | $150 – $1,500+ | Varies significantly by state |

| MPRE Registration Fee | $150 – $160 | Standardized ethics exam |

| Character & Fitness Application Fee | $100 – $500+ | Background check, varies by state |

| Laptop Fee (if applicable) | $50 – $200 | For using a laptop during the exam |

| Travel & Lodging (if exam is away) | $300 – $1,000+ | Flights/gas, hotel, meals |

| Estimated Monthly Living Expenses (x2-3) | $1,500 – $3,000+ /month | Rent, food, utilities, etc. |

| Estimated Total (excluding living) | $2,000 – $7,350+ | |

| Estimated Total (with living) | $5,000 – $16,000+ | Depending on living costs and duration |

Are You Eligible for a Bar Exam Loan?

Okay, so who can actually get one of these loans? Lenders have a checklist :

- Law School Status: Usually, you need to be in your final year of an ABA-accredited law school or have graduated from one within the last 12 months.

- Bar Exam Timing: You’ll also need to plan to take the bar exam relatively soon, often within 12 months of graduation.

- Citizenship: Most lenders require you to be a U.S. citizen or permanent resident. We’ll touch on international students in a bit.

The Big One: Creditworthiness – Your Financial Report Card

This is a major hurdle for private loans. Lenders want to see that you have a good track record of managing debt. A strong credit score is your best friend here.

What’s ‘good’ credit?

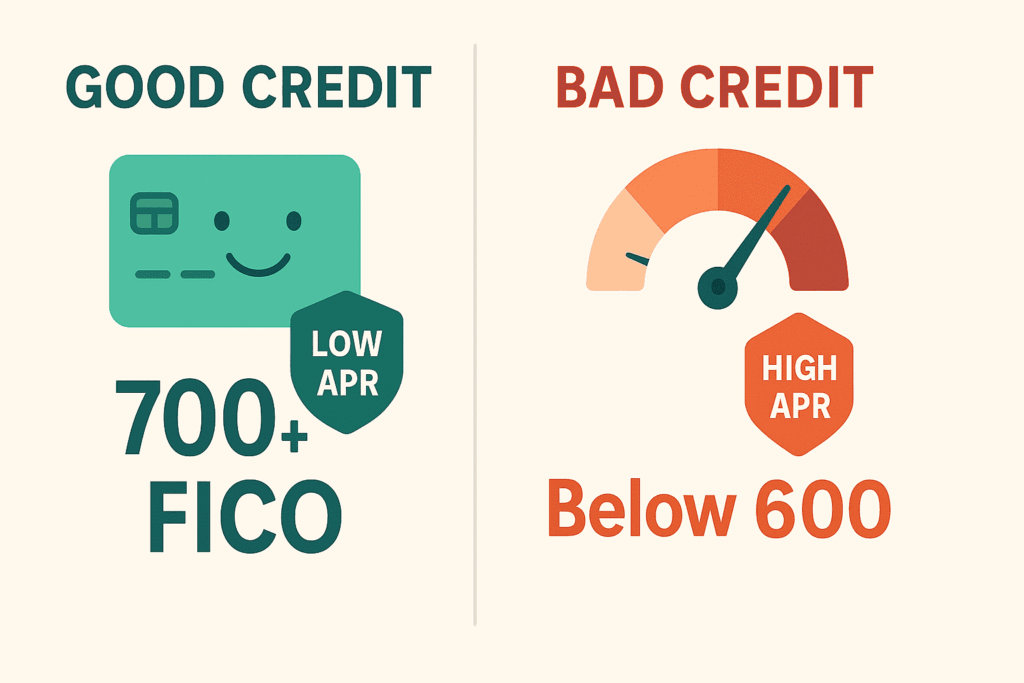

While it varies, many private student loan lenders look for FICO scores generally in the mid-600s or higher to even consider you, and much higher, around 700-750+ for their best interest rates.

Lenders perceive borrowers with stronger credit histories as lower risk, which often translates not only to a higher chance of getting the loan but also to more favorable terms, like a lower interest rate.

Conversely, a weaker credit history can mean a higher risk for the lender, potentially leading to a loan denial, a requirement for a cosigner, or a higher interest rate if approved. This is especially true for bar loans, as many applicants are studying full-time and have no income during this period.

If your credit history is a bit shaky or limited, don’t panic – that’s where a cosigner comes in.

A cosigner is someone with good credit, often a parent or close relative, who agrees to take responsibility for the loan if you can’t pay it back.

Having a creditworthy cosigner can significantly boost your chances of approval and might even get you a lower interest rate. However, asking someone to cosign is a big deal. They become legally responsible for the debt if you can’t make payments, which can affect their credit and financial situation.

Because of this shared responsibility, a feature called ‘cosigner release’ is very attractive. This means after you’ve made a certain number of on-time payments and meet other credit criteria, your cosigner can be taken off the loan.

Special Considerations for International Students

For international students, getting a bar exam loan is trickier. Most U.S. lenders will require you to have a creditworthy cosigner who is a U.S. citizen or permanent resident.

While some lenders offer loans to international students without a U.S. cosigner for academic programs, these are generally for degree-related costs during enrollment. Always check the lender’s specific requirements for bar study loans if you’re an international student.

Alternatives to the Bar Exam Loan

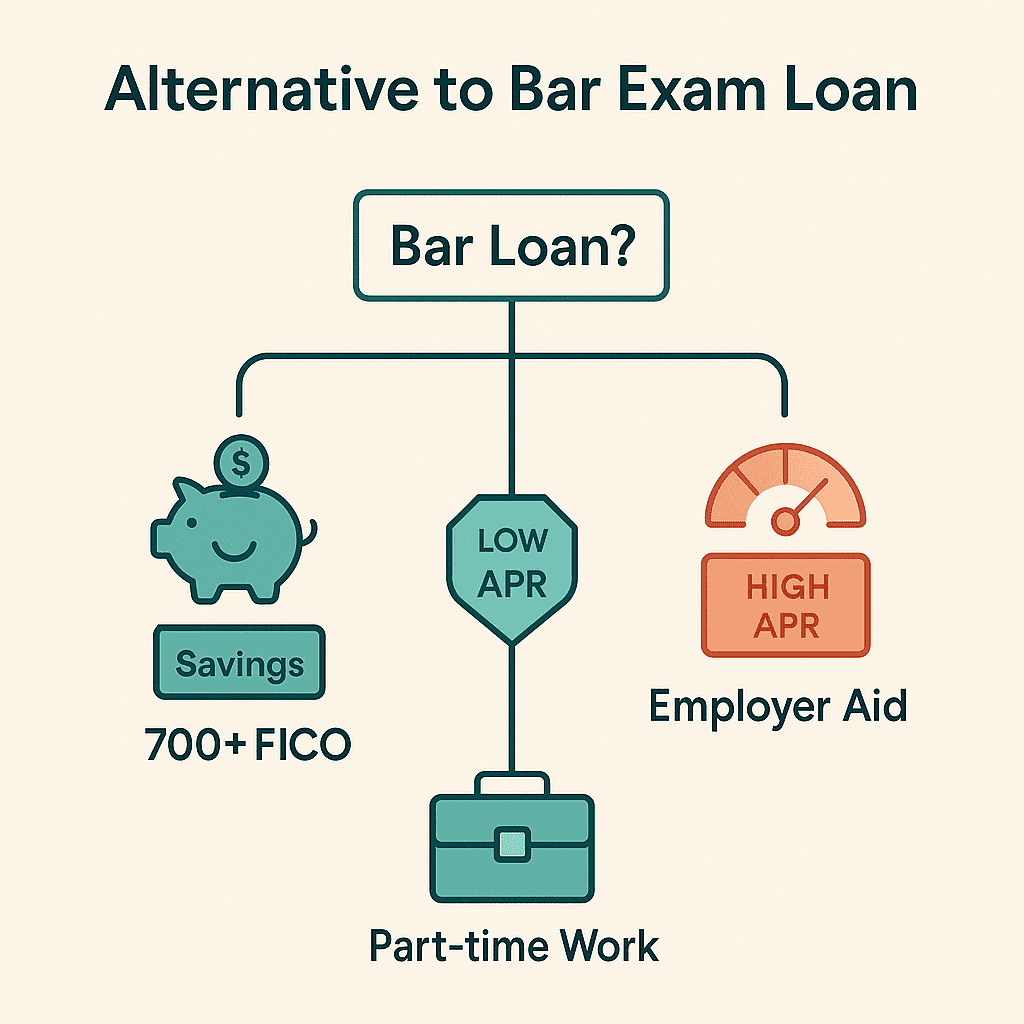

Before you jump into a private bar loan, it’s smart to explore other, often cheaper, ways to cover your bar prep costs. Think of bar loans as a last resort or a way to fill any remaining gaps.

- Your Own Savings: If you’ve been able to stash away some cash during law school, now’s the time to use it. Every dollar you save is a dollar you don’t have to borrow.

- Leftover Federal Student Loans (If Applicable): If you’re still in your final semester and haven’t used up all your federal student loan eligibility for the academic year, talk to your financial aid office.

These loans generally have better terms and more protections than private loans. Some schools may allow an increase to your Cost of Attendance to include bar exam registration fees, which could increase federal loan eligibility. - Scholarships and Grants: Yes, there are scholarships and grants specifically for bar study. Search online, ask your law school, and check with bar associations. Free money is the best money! Securing these can directly reduce the amount you need from a loan, lowering your future debt and interest payments.

- Employer Assistance: If you’ve already landed a job, your firm might help out. Many larger firms, especially, reimburse bar exam fees and prep course costs. Some even offer stipends or salary advances.

- Working Part-Time: Some people manage to work part-time while studying. It’s tough, as bar prep is like a full-time job itself, but it can reduce the amount you need to borrow. Be realistic about how much you can handle; this is a highly individual decision that trades income for study time and could impact exam performance if not managed well.

- Family Support: If you have family willing and able to help, it’s worth a conversation. Even small contributions can reduce your loan needs.

Federal vs. Private Loans for Bar-Related Expenses

| Feature | Federal Loans | Private Bar Loans |

|---|---|---|

| Interest Rates | Fixed, set annually by Congress | Fixed or Variable; based on creditworthiness & market rates |

| Borrower Protections | Income-Driven Repayment, PSLF, more generous deferment/ forbearance | Limited; typically lender-specific forbearance, no IDR/PSLF |

| Credit Requirement | No adverse credit; Unsubsidized: No credit check | Good to Excellent credit generally required |

| Cosigner | Not usually for student; Endorser if adverse credit | Often needed if primary borrower has limited/poor credit |

| Use for Living Expenses (Study) | Possible if part of Cost of Attendance increase for exam fees | Primary purpose, funds disbursed directly to the borrower |

The Application Process: Step-by-Step to Secure Your Funds

Ready to apply? It’s usually a straightforward online process. Here’s a typical roadmap:

Check Your Credit & Do Your Homework (Research & Pre-Qualification)

Before you even fill out an application, get a free copy of your credit report. Check for any errors that might be dragging your score down and dispute them if needed. It helps you gauge your chances and what kind of rates you might expect.

Then, compare the lenders and look at their current rates, fees, and terms on their official websites. Some lenders offer a pre-qualification tool that lets you see potential rates with a ‘soft’ credit check, which doesn’t hurt your score.

Gather Your Documents

Lenders will need some info from you (and your cosigner, if you have one). Typically, this includes:

- Social Security number

- Government-issued ID, like a driver’s license

- Proof of enrollment or graduation from your law school

- Information about your law school

- Income information, if any, is often more critical for the cosigner

- The amount you want to borrow

Complete the Application

Most applications are online and can be pretty quick. Fill it out carefully and double-check all your information.

School Certification (Maybe)

Some lenders might need your law school to certify your enrollment status or graduation date, even though the loan isn’t for tuition. This is usually handled between the lender and the school’s financial aid office after you apply.

This certification serves as a verification step for the lender, confirming you are a genuine bar candidate and meet their eligibility criteria, e.g., final year, recent grad from an ABA-accredited school, which helps reduce the lender’s risk.

Approval and Getting Your Money

Approval can sometimes happen the same day. If approved, you’ll get a loan agreement to review and sign electronically. The funds are then disbursed directly to your bank account, not your school. You might be able to choose one lump sum or two separate disbursements.

This direct disbursement is a key feature, but it immediately places the full responsibility of managing the funds on you, unlike federal tuition loans, which are often sent to the school first.

Realistic Loan Examples

It helps to run some numbers for a typical bar loan vs. a federal loan scenario. For example, suppose you borrow $15,000 through a private bar study loan at about 11.19% APR, repaying over 15 years.

So, it would be roughly 179 monthly payments of $188.20, plus a final smaller payment for a total repayment of about $33,752. That means you’d pay more than double the amount borrowed because of interest and the long-term.

By comparison, using federal loans to cover bar exam costs might look very different. If you took a $10,000 Federal Grad PLUS loan at roughly 7.5% APR over 10 years, the monthly payment would be about $119, and the total repaid would be about $14,240, including interest.

The table below shows these two scenarios side by side for clarity:

| Loan Scenario | Loan Amount | APR (fixed) | Term | Monthly Payment | Total Paid |

|---|---|---|---|---|---|

| Private Bar Study Loan (example) | $15,000 | 11.19% | 15 years | $188.20 (approx.) | $33,752 (approx.) |

| Federal Grad PLUS Loan (est.) | $10,000 | 7.50% (est.) | 10 years | $119 (approx.) | $14,240 (approx.) |

These numbers clearly show how much interest adds up. Even though the private loan’s monthly payment is higher, the long-term and higher rate make the total cost much greater. Your own offer may differ based on credit and lender, so calculate carefully.

Understanding Repayment: The Not-So-Fun Part

- When It Begins: You’ll typically start repaying your bar loan after your grace period ends, usually 6 to 9 months after you graduate or leave school.

- Repayment Options: Unlike federal loans, private bar loans have fewer standard repayment plans. You’ll likely have a fixed monthly payment based on your loan amount, interest rate, and term. Some lenders might offer an initial period of interest-only payments.

- The Importance of On-Time Payments: Missing payments can lead to late fees, damage your credit score, and in worst-case scenarios, loan default.

Set up automatic payments if possible to avoid this. While these loans address a short-term cash flow problem, their repayment terms mean that mismanagement or over-borrowing has lasting financial consequences, adding to an already significant law school debt load.

Final Thoughts

Phew! That was a lot of information, but financing your bar exam is a big deal. Taking the time to understand your options, especially bar exam loans, is a crucial step in launching your legal career.

Remember, a bar exam loan is a tool. And like any tool, it needs to be used wisely and responsibly. It’s not free money, and it comes with real obligations. The decisions you make now about funding this short, intensive period can have long-term financial effects, so informed choices are key.

So, shop around for the best rates and watch for discounts. With thoughtful planning, you can cover your bar exam costs without unnecessary financial stress and focus on passing the exam with confidence.

Ready to study effectively for the bar exam? Explore our top bar prep courses and available discounts from Barmax, Crushendo, Kaplan, and Quimbee.

FAQs

Bar loan programs typically allow borrowing from around $1,000 up to $15,000–$16,000, depending on the lender. The exact limit varies, but $15k is a common maximum.

Interest rates on bar loans depend on your credit and the lender, and are typically higher than federal student loans. They often range from low single digits up to double digits.

Most bar loans let you defer payments until after law school. Typically, there is a grace period of 6–9 months post-graduation or after the exam, before you begin monthly payments.

Private bar loans are credit-based, so a strong credit score or a creditworthy cosigner can help you qualify and get a better rate. International students must have a U.S. citizen or permanent resident cosigner.

This is an important consideration. If you don’t pass the bar exam, you are still responsible for repaying the bar loan according to its terms, including any accrued interest.